Shine vs Qonto: Choosing the best business banking solution

- 01Shine vs Qonto: overview

- 02What's the difference between Shine and Qonto?

- 03Shine pros and cons

- 04Qonto pros and cons

- 05Shine compared to Qonto

- 06Qonto compared to Shine

- 07Features comparison

- 08Shine vs Qonto: Which is the best for your business?

- 09Promotions on Accounting software

- 10Alternatives to Shine & Qonto

Access up to $90 savings on Shine & $100 on Qonto

Shine

3 months free on Premium plan

Access up to $90 savings on Shine & $100 on Qonto

Maximizing the financial management of your business is crucial for its success, facilitating smoother operations, informed decision-making, and financial stability. However, with numerous options available, choosing the right banking solution tailored to your business needs can be daunting.

In this comparison, we delve into the specifics of Shine vs Qonto, two prominent players in the digital banking category, to assist you in making an informed decision for your business's financial future.

Shine vs Qonto: overview

Shine and Qonto are two leading digital banking platforms, each offering distinct features tailored to different business requirements.

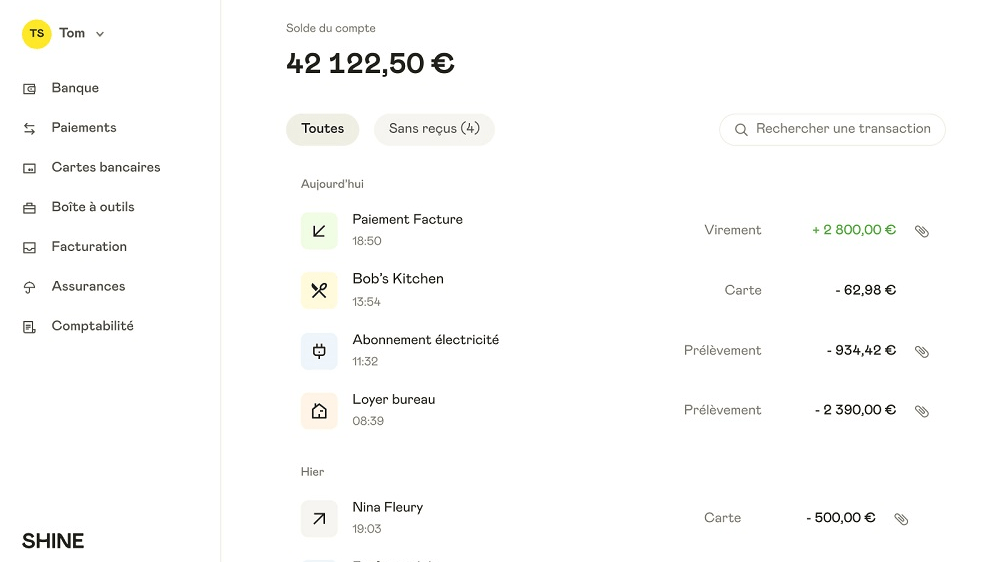

Shine is widely recognized for its user-friendly interface and intuitive financial management tools. It simplifies accounting tasks, expense tracking, and invoicing, making it an ideal choice for freelancers, small businesses, and startups seeking streamlined financial solutions. Qonto, on the other hand, stands out for its advanced banking features designed specifically for businesses. With Qonto, users gain access to multi-currency accounts, expense categorization, real-time payment notifications, and seamless integration with accounting software, catering to the needs of established companies and growing enterprises alike.

Now, let's dive into the comparison of Shine vs Qonto. We'll examine their key functionalities and benefits to help you determine the best banking platform to support your business's financial operations.

What's the difference between Shine and Qonto?

Shine and Qonto are prominent digital banking platforms designed to streamline financial management for businesses of all sizes. While both platforms offer core features such as expense tracking, invoicing, and real-time notifications, they differ in their additional offerings and user interfaces.

Shine is recognized for its simplicity and user-friendly interface, which are ideal for freelancers and small businesses looking for straightforward financial management tools. This simplicity allows users to quickly adapt to the platform without a steep learning curve, making Shine a great choice for those prioritizing efficiency and ease of use.

Conversely, Qonto sets itself apart with a robust array of advanced banking features designed specifically for larger businesses and rapidly growing enterprises. With offerings such as multi-currency accounts, sophisticated expense categorization, and seamless integrations with leading accounting software, Qonto addresses the complex needs of established companies seeking depth and breadth in their financial operations.

The user interfaces of Shine and Qonto also highlight their focus on different user groups. Shine’s intuitive design facilitates easy access to financial tools, making it highly accessible for those new to digital banking. Qonto, while more complex, provides a comprehensive suite of features that offer significant advantages in terms of functionality and flexibility for businesses looking to enhance their financial management capabilities.

In summary, while both Shine and Qonto offer essential financial management tools, their additional features and user interfaces cater to different business needs and preferences.

3 months free on Premium plan on Shine

Get 3 months free on Premium plan on Shine and up to $90 savings with Secret.

Shine pros and cons

What are the advantages of Shine?

- User-friendly interface: Shine offers a user-friendly interface that makes it easy for business owners to manage their finances without requiring extensive financial knowledge or experience.

- Expense tracking: Shine provides robust expense tracking features, allowing users to monitor their spending, categorize expenses, and generate detailed reports to track their financial health.

- Invoicing: Shine simplifies the invoicing process for businesses by offering customizable invoice templates, automated reminders for overdue invoices, and seamless integration with accounting software.

- Real-time notifications: With Shine, users receive real-time notifications for transactions, account balances, and other important financial activities, helping them stay informed and in control of their finances.

- Customer support: Shine offers responsive customer support to assist users with any questions or issues they may encounter while using the platform, ensuring a smooth experience.

What are the disadvantages of Shine?

- Limited banking features: Compared to traditional banks, Shine may have limited banking features, such as the absence of physical branches or certain banking services that some businesses may require.

- Integration limitations: While Shine integrates with some accounting software, it may have limitations in terms of integration options with other third-party tools or platforms, potentially limiting its functionality for some users.

- Limited business accounts: Shine may have restrictions on the number of business accounts or users allowed under certain plans, which could be a drawback for larger businesses or those with complex financial needs.

- Transaction fees: While Shine may offer free transactions up to a certain limit, there may be transaction fees or charges associated with exceeding those limits, which could impact the overall cost for businesses with high transaction volumes.

- Security concerns: As with any online banking platform, there may be security concerns associated with using Shine, such as the risk of data breaches or unauthorized access to sensitive financial information, requiring users to implement proper security measures and protocols.

Qonto pros and cons

What are the advantages of Qonto?

- Advanced banking features: Qonto offers a wide range of advanced banking features tailored to businesses, including multi-currency accounts, expense categorization, and real-time payment notifications, providing greater flexibility and control over finances.

- Integration capabilities: Qonto seamlessly integrates with various accounting software, invoicing tools, and other third-party applications, allowing for streamlined financial management and improved workflow efficiency.

- Scalability: Qonto's scalable solutions cater to businesses of all sizes, from startups to established enterprises, with customizable plans and features to accommodate changing financial needs as businesses grow.

- Customer service: Qonto provides responsive customer support via multiple channels, including email, phone, and live chat, ensuring timely assistance and resolution of queries or issues faced by users.

- Security measures: Qonto prioritizes security with advanced encryption protocols, multi-factor authentication, and real-time transaction monitoring, offering peace of mind to users regarding the safety and integrity of their financial data.

What are the disadvantages of Qonto?

- Subscription fees: Qonto's subscription-based pricing model may involve monthly or annual fees, which could be a potential drawback for businesses operating on tight budgets or looking to minimize overhead costs.

- Transaction limits: Some Qonto plans may impose transaction limits or additional fees for exceeding certain thresholds, which could impact businesses with high transaction volumes or frequent banking activity.

- Learning curve: Qonto's comprehensive features and functionalities may have a learning curve for new users, requiring time and effort to fully explore and utilize the platform's capabilities effectively.

- Limited international support: While Qonto offers multi-currency accounts, its international support may have limitations in terms of currency coverage, international transfers, or foreign exchange rates compared to traditional banks or specialized international banking solutions.

- Dependency on digital platforms: Qonto operates primarily as a digital banking platform, which may pose challenges for businesses requiring in-person banking services or physical branches for certain transactions or banking needs.

Compare Qonto to other tools

Shine compared to Qonto

Shine and Qonto represent two prominent digital banking platforms, each offering unique features tailored to businesses of varying sizes and needs. Shine stands out for its user-friendly interface, simplifying financial management tasks like expense tracking and invoicing.

In contrast, Qonto provides advanced banking features such as multi-currency accounts and real-time payment notifications, catering to more established enterprises. While Shine prioritizes simplicity and accessibility, Qonto emphasizes scalability and comprehensive financial solutions.

Is Shine better than Qonto?

Determining whether Shine or Qonto is the superior digital banking platform hinges on the specific requirements and scale of a business. Shine excels in offering an intuitive experience, particularly beneficial for small businesses or freelancers seeking straightforward financial management tools. Its focus on ease of use enables users to efficiently manage expenses and generate invoices, making it a solid choice for those valuing simplicity.

On the other hand, Qonto is designed with larger, more mature businesses in mind, providing sophisticated banking functionalities such as the ability to handle transactions in multiple currencies and offering instant updates on payments. This makes Qonto an ideal option for enterprises looking for a robust financial platform that can support their growth and complex needs.

What is Shine best used for?

Shine is best used for streamlining financial management tasks for freelancers, small businesses, and startups. Its user-friendly interface simplifies activities such as expense tracking, invoicing, and generating financial reports. Shine's intuitive platform enables users to stay organized and in control of their finances without requiring extensive financial knowledge or experience.

Additionally, Shine's focus on providing seamless banking solutions tailored to the needs of small businesses makes it an ideal choice for those looking to optimize their financial operations efficiently. Overall, Shine is most beneficial for businesses seeking a straightforward and accessible tool for managing their finances effectively.

Can Shine replace Qonto?

While Shine offers robust financial management tools suitable for freelancers, small businesses, and startups, it may not entirely replace Qonto for larger or more established enterprises. Qonto provides advanced banking features like multi-currency accounts, expense categorization, and real-time payment notifications, catering to businesses with more complex financial needs. A

Additionally, Qonto's scalability and comprehensive solutions make it better suited for businesses requiring extensive banking functionalities and flexibility. While Shine excels in simplicity and accessibility, Qonto offers a broader range of features and services, making it less likely to be replaced entirely by Shine for businesses seeking more sophisticated financial solutions.

Is Shine cheaper than Qonto?

Determining whether Shine is cheaper than Qonto depends on the specific needs and usage patterns of the business. Shine’s pricing model typically offers more affordable pricing plans tailored to freelancers, small businesses, and startups, making it an attractive option for those operating on tighter budgets.

However, Qonto may provide more comprehensive banking features and services for larger or more established enterprises, potentially justifying its higher cost. Evaluating factors such as transaction fees, account limits, and additional features included in each platform's pricing plans is essential in determining which option offers the best value for money based on the business's requirements and financial objectives.

Is there a better Accounting software than Shine?

While Shine offers robust financial management tools tailored to freelancers, small businesses, and startups, it's worth exploring alternative software options to determine the best fit for specific needs and preferences.

Qonto, for example, offers advanced banking features like multi-currency accounts and real-time payment notifications, catering to businesses with more complex financial requirements.

Additionally, other digital banking platforms such as Brex, Revolut Business, Mercury, and Tide provide unique features and benefits that may better suit certain businesses, depending on factors like transaction volume, international operations, and integration capabilities.

3 months free on Premium plan on Shine

Get 3 months free on Premium plan on Shine and up to $90 savings with Secret.

Qonto compared to Shine

Qonto and Shine are prominent digital banking platforms, each offering distinct features catering to diverse business needs. Qonto stands out for its advanced banking functionalities tailored to larger enterprises, including multi-currency accounts and real-time payment notifications.

Meanwhile, Shine excels in simplicity and accessibility, making it an ideal choice for freelancers, small businesses, and startups seeking streamlined financial management solutions. While Qonto prioritizes scalability and comprehensive banking features, Shine emphasizes user-friendly interface and ease of use.

Is Qonto better than Shine?

Whether Qonto is superior to Shine largely depends on the specific demands and scale of the business in question. For larger corporations or rapidly expanding enterprises, Qonto presents a compelling case with its suite of advanced banking tools designed to accommodate complex financial operations. Its offerings, like multi-currency accounts and immediate payment alerts, cater to the intricate needs of established businesses requiring extensive banking solutions.

In contrast, Shine’s appeal lies in its straightforward approach, ideal for those who prioritize a seamless user experience over elaborate functionalities. Freelancers and small businesses may find Shine more aligned with their needs for easy-to-navigate financial management.

What is Qonto best used for?

Qonto is best used for businesses requiring advanced banking solutions tailored to their specific needs. Its features cater to larger enterprises, offering multi-currency accounts, expense categorization, and real-time payment notifications.

With scalability at its core, Qonto provides comprehensive financial management tools suitable for businesses seeking flexibility and control over their finances. Its robust integration capabilities streamline workflow processes, making it ideal for businesses with complex financial operations. Qonto's emphasis on security and compliance ensures peace of mind for users, making it a preferred choice for those prioritizing reliability and efficiency in their banking experience.

Can Qonto replace Shine?

While Qonto offers advanced banking features suitable for larger enterprises, it may not entirely replace Shine for smaller businesses, freelancers, and startups. Qonto's emphasis on multi-currency accounts, expense categorization, and real-time payment notifications caters to businesses with more complex financial needs.

However, Shine excels in simplicity and accessibility, providing streamlined financial management tools tailored to the specific requirements of smaller entities. While Qonto offers scalability and comprehensive solutions, Shine may better suit businesses seeking straightforward and user-friendly financial management solutions.

Is Qonto cheaper than Shine?

Determining whether Qonto is cheaper than Shine depends on various factors such as business size, transaction volume, and required features. While Qonto may offer advanced banking functionalities suitable for larger enterprises, its pricing structure could be higher compared to pricing structure of Shine, particularly for smaller businesses or startups with limited financial resources. Therefore, businesses should carefully evaluate their specific needs and compare the costs and benefits of each platform to make an informed decision regarding which option offers the best value for their money.

Shine's more affordable plans tailored to smaller businesses, freelancers, and startups. Additionally, transaction fees, account limits, and additional features included in each platform's pricing plans should be considered when evaluating the overall cost-effectiveness.

Is there a better Accounting software than Qonto?

When assessing digital banking platforms, it's crucial to explore alternatives beyond Qonto to meet your business's distinct demands. While Qonto caters to larger enterprises with its advanced banking features, other options might better suit specific requirements.

For instance, Spendesk offers comprehensive expense management tools, facilitating expense tracking and approvals for businesses of all sizes. Expensify specializes in automated expense reporting, simplifying reimbursement processes and reducing administrative burden. Ramp stands out with its focus on corporate cards and expense management, providing businesses with greater control over spending. Similarly, N26 offers a digital banking solution with flexible account options and convenient features tailored to freelancers and small businesses.

2 months free on the Basic and Smart plans on Qonto

Get 2 months free on the Basic and Smart plans on Qonto and up to $100 savings with Secret.

Features comparison

Qonto's Superior Invoicing Tool Outperforms Shine

Both Qonto and Shine offer robust solutions designed to streamline invoicing processes, but Qonto's approach provides a more comprehensive and efficient system, making it a better choice for businesses looking for enhanced functionality.

While Shine offers a straightforward integrated billing tool that supports the creation of estimates and invoices, along with sending automatic reminders, it primarily caters to simpler, smaller-scale operations. On the other hand, Qonto's invoicing tool is designed to meet the demands of more complex and larger business environments. Qonto enables users to effortlessly generate detailed quotes and invoices, and its sophisticated tracking system ensures that payments are monitored closely, with reminders sent automatically to manage outstanding invoices effectively. This comprehensive management not only facilitates better cash flow but also enhances the overall financial workflow.

Shine's Favorable Loan Options Surpass Qonto's Financing Recommendations

Shine stands out by offering business loans at preferential rates, providing expedited access to funds within 72 hours for various purposes including premises, equipment, and business development. This feature caters to businesses seeking quick financial aid to support their growth or operations.

In contrast, while Qonto recommends financing partners and streamlines the application process, it does not directly provide financing options like Shine. Thus, Shine's ability to offer favorable loan terms and expedited funding release distinguishes it as an attractive choice for businesses in need of prompt financial assistance.

Shine Excels in User-Friendliness, While Qonto Leads in Advanced Functionality

Shine and Qonto both aim to provide seamless user experiences but excel in different areas.

Shine boasts an exceptionally intuitive interface, catering to users across all proficiency levels. Its minimalist design seamlessly integrates functionality, with clearly labeled sections and comprehensive tutorials. For instance, Shine's streamlined setup process ensures entrepreneurs swiftly initiate operations without technical hurdles.

Conversely, Qonto shines in advanced functionality, albeit with a slightly steeper learning curve. Its feature-rich platform offers a broad spectrum of tools, ensuring robust financial management solutions. While initial familiarity with Qonto may require more time, it's an optimal choice for those seeking sophisticated SaaS solutions tailored to their specific business needs.

Qonto Integrations Outshine Shine's Offerings

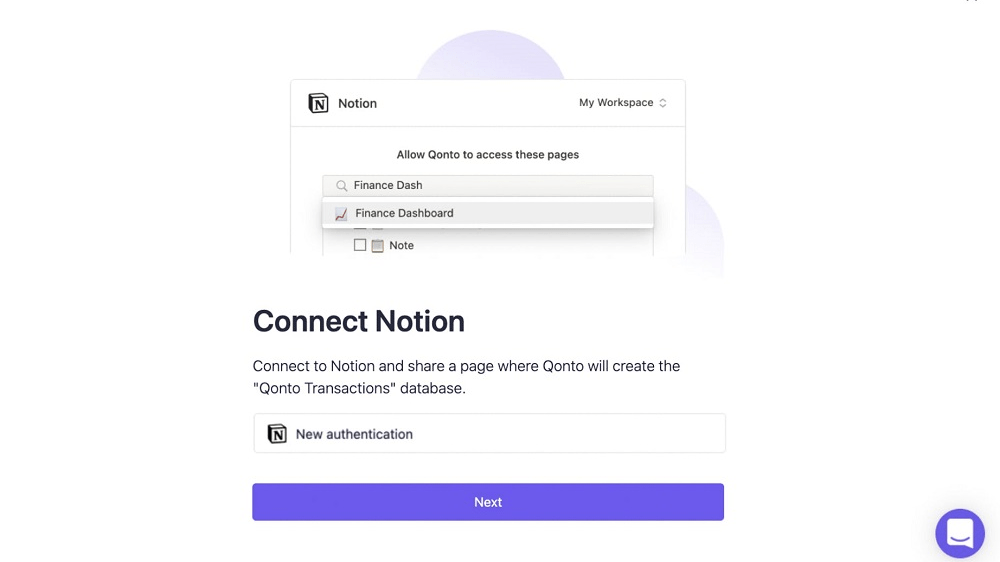

When it comes to integrations, Qonto outshines Shine with its extensive range catering to diverse business needs. Qonto seamlessly integrates with leading accounting software like Xero and QuickBooks, streamlining financial management processes. Additionally, it offers compatibility with popular invoicing tools such as FreshBooks and Wave, ensuring smooth invoicing workflows. Qonto's integration with payment gateways like Stripe and PayPal facilitates seamless transaction processing, enhancing overall efficiency.

In contrast, while Shine offers some integrations, its range may be more limited, potentially limiting versatility for businesses with diverse software requirements. Qonto's comprehensive integration ecosystem positions it as a preferred choice for businesses seeking seamless interoperability with various platforms.

Qonto's Advanced Expense Categorization Sets It Apart from Shine

Qonto distinguishes itself with automatic expense categorization, providing users with precise insights into expenditure patterns and simplifying accounting processes. This feature enables users to accurately track where their money is being spent, enhancing financial transparency and efficiency.

In contrast, while Shine offers streamlined accounting solutions, it lacks the specific feature of automatic expense categorization offered by Qonto. This aspect gives Qonto a distinct advantage for businesses seeking advanced expense tracking capabilities within their banking platform.

Both Shine and Qonto Provide Equally Robust and Simplified Accounting

Shine and Qonto prioritize simplified accounting processes, each offering robust features to streamline financial management. Shine's approach includes automatic document reminders, document storage, and automated exports, ensuring users stay organized with their financial documents effortlessly.

Similarly, Qonto simplifies accounting tasks by facilitating payment receipts, VAT collection, and expense reports. Both platforms prioritize user-friendly interfaces and automation to make accounting more manageable for users. While Shine excels in document management, Qonto's focus on payment processing enhances overall efficiency, providing users with versatile options to streamline their accounting tasks effectively.

Qonto's Superior Team Collaboration Features Outshine Shine

In terms of team collaboration features, Qonto surpasses Shine with its robust multi-user access functionality. Qonto allows users to seamlessly collaborate with their teams by granting varying levels of permissions, controlling access to features like making payments and viewing transactions.

For example, administrators can assign roles to team members, ensuring appropriate access levels and enhancing overall security. This feature fosters better team coordination and oversight, a crucial aspect for businesses managing finances collaboratively. In contrast, Shine's lack of multi-user access may limit its suitability for businesses requiring extensive team collaboration capabilities within their banking platform.

Subscribe to our newsletters.

No FOMO here. Stay up-to-date on all the latest deals and news with our monthly newsletter straight to your inbox like 126,000+ entrepreneurs (+ Get 10% off on on our Premium Membership!)

Shine vs Qonto: Which is the best for your business?

Shine is the best tool for you if:

- You're a freelancer or run a small business looking for a banking solution that simplifies expense tracking, invoicing, and financial management without overwhelming features.

- You value a user-friendly interface that allows for quick navigation and easy access to essential banking operations, making it less time-consuming to manage your finances.

- You prefer a digital banking platform with straightforward pricing and no hidden fees, ensuring you can budget effectively without worrying about unexpected costs.

- You need a banking partner that offers efficient customer support tailored to the needs of small businesses, providing peace of mind for any financial queries or issues.

- You are interested in leveraging integrated tools for financial management, such as automatic categorization of expenses and the creation of professional invoices, to streamline your administrative tasks.

Qonto is the best tool for you if:

- Your business requires advanced banking features like multi-currency accounts, real-time payment notifications, and the ability to manage complex financial operations efficiently.

- You're scaling up and need a digital banking solution that offers scalability and sophisticated financial tools to support growth, including seamless integrations with accounting software.

- You value detailed financial insights and analytics to make informed decisions, with access to comprehensive reporting tools that help track cash flow and expenses accurately.

- You operate in multiple countries and need a banking platform that supports international transactions, offering competitive exchange rates and the flexibility of handling different currencies.

- You prioritize security and reliability in your banking operations, seeking a platform that provides robust security measures to protect your business's financial data and transactions.

3 months free on Premium plan on Shine

Get 3 months free on Premium plan on Shine and up to $90 savings with Secret.

Alternatives to Shine & Qonto

Promotions on Accounting software

Start saving on the best SaaS with Secret.

Secret has already helped tens of thousands of startups save millions on the best SaaS like Shine, Qonto & many more. Join Secret now to buy software the smart way.