Stripe vs PayPal: Choosing the right payment gateway for your business

- 01Stripe vs PayPal: overview

- 02What's the difference between Stripe and PayPal?

- 03Stripe pros and cons

- 04PayPal pros and cons

- 05Stripe compared to PayPal

- 06PayPal compared to Stripe

- 07Features comparison

- 08Stripe vs PayPal: Which is the best for your business?

- 09Promotions on Payments software

- 10Alternatives to Stripe & PayPal

Save up to $500 on Stripe

Save up to $500 on Stripe

Selecting the ideal online payment platform is crucial for managing financial transactions effectively and providing a seamless payment experience for your customers. These platforms play a pivotal role in enhancing financial processes, ensuring secure transactions, and expanding your reach in the digital marketplace.

With numerous options available, such as Stripe and PayPal, it can be challenging to determine the best fit for your business's payment processing needs. In this article, we aim to simplify the decision-making process by offering a comprehensive comparison of Stripe vs PayPal. By exploring their key features, security measures, ease of use, and pricing models, you'll gain the insights necessary to make an informed choice for your business's online payment solution.

Stripe vs PayPal: overview

Stripe and PayPal are two major players in the world of online payment processing, each catering to specific needs and preferences when it comes to managing financial transactions.

Stripe is renowned for its developer-friendly approach and flexibility. It offers a wide range of customization options, extensive support for various payment methods, and a reputation for seamless integration into websites and applications. On the other hand, PayPal is known for its widespread recognition and user-friendly interface, making it a popular choice for both individuals and businesses looking for a straightforward payment solution.

In the upcoming comparison of Stripe vs. PayPal, we'll thoroughly examine their features, security measures, ease of implementation, and pricing structures. By the end of this analysis, you'll have the knowledge needed to determine which online payment gateway aligns best with your specific business requirements. Let's start by taking a closer look at the key attributes of these two leading payment processing platforms.

What's the difference between Stripe and PayPal?

Stripe and PayPal are two prominent players in the online payment processing industry, each offering distinct features and approaches to help businesses manage their financial transactions effectively.

Stripe, known for its developer-centric approach, is highly customizable and offers extensive support for various payment methods. It's an excellent choice for businesses seeking flexibility and advanced customization options. With Stripe, developers have more control over the payment process and can tailor it to their specific needs. Stripe's transparent pricing model, which charges based on successful transactions, appeals to businesses of all sizes.

In contrast, PayPal is renowned for its widespread recognition and user-friendly interface. It provides a straightforward and hassle-free way for both individuals and businesses to send and receive payments. PayPal's brand recognition instills trust in customers, and its ease of use makes it accessible to a broad audience. While PayPal also offers customization options for more advanced users, its primary strength lies in its simplicity and convenience.

The key differences between Stripe and PayPal revolve around their target audiences, customization options, and pricing structures. Stripe is geared towards businesses that require more control and flexibility in their payment processing, making it a top choice for e-commerce platforms and developers. PayPal, on the other hand, is a versatile solution suitable for businesses of all sizes, with a focus on simplicity and user-friendliness.

Additionally, Stripe and PayPal have different fee structures. Stripe charges a percentage-based fee per transaction, while PayPal combines a percentage-based fee with a fixed fee per transaction. Understanding these fee structures is crucial in determining which platform aligns better with your business's financial needs.

Stripe pros and cons

What are the advantages of Stripe?

- Easy integration: Stripe offers well-documented APIs and extensive developer resources, making it relatively easy to integrate into websites and mobile applications. This simplifies the process of setting up payment processing for businesses.

- Customization: Stripe provides a high level of customization, allowing businesses to tailor the payment experience to their specific needs. This includes support for different payment methods, currencies, and subscription models.

- Security: Stripe is known for its robust security measures. It is fully compliant with PCI DSS (Payment Card Industry Data Security Standard) requirements, and it handles sensitive customer data securely, reducing the burden of security compliance on businesses.

- Global reach: Stripe supports payments in over 135 countries and accepts a wide range of payment methods, making it a suitable choice for businesses with international customers. It also offers localized payment options to enhance the user experience.

- Transparent pricing: Stripe's pricing is straightforward and transparent, with no setup fees or monthly charges. Businesses are only charged when they successfully process transactions, which can be advantageous for startups and small businesses.

What are the disadvantages of Stripe?

- Complexity for beginners: While Stripe is developer-friendly, it can be complex for beginners who lack technical expertise. Setting up advanced features and customization may require coding skills.

- Holdback period: Stripe has a holdback period for new accounts, during which they withhold a portion of your funds for a certain number of days as a security measure. This can affect cash flow for new businesses.

- Support: Some users have reported challenges with Stripe's customer support, particularly with longer response times. This can be frustrating if you encounter issues that require immediate assistance.

- Chargeback fees: Stripe charges fees for chargebacks, which are disputes initiated by customers. These fees can add up if your business experiences frequent chargebacks.

- Limited in-person payments: Stripe is primarily designed for online payments, so it may not be the best choice for businesses that rely heavily on in-person transactions, such as retail stores.

Compare Stripe to other tools

PayPal pros and cons

What are the advantages of PayPal?

- Widespread recognition: PayPal is one of the most recognized and trusted online payment brands globally. Many customers are familiar with PayPal and may feel more comfortable using it for transactions.

- User-friendly: PayPal offers a straightforward and user-friendly interface, making it accessible to both individuals and businesses. Setting up an account and making payments is relatively easy.

- Versatility: PayPal supports a wide range of payment methods, including credit/debit cards, bank transfers, and PayPal balances. This versatility can be advantageous for businesses with diverse customer bases.

- Buyer and seller protection: PayPal provides certain buyer and seller protection measures, helping to mitigate risks associated with disputes and fraudulent transactions. This can enhance trust between buyers and sellers.

- Mobile-friendly: PayPal offers mobile apps and a mobile-optimized website, making it convenient for customers to make payments on smartphones and tablets.

What are the disadvantages of PayPal?

- High fees: PayPal's transaction fees can be relatively high, especially for international transactions or micropayments. These fees can eat into a business's profit margins, particularly for small transactions.

- Account holds: PayPal is known for placing holds on accounts and funds, especially for new or high-risk accounts. This can disrupt cash flow and cause inconvenience for businesses.

- Limited customization: While PayPal is user-friendly, it may not offer as much customization and control over the payment experience as some other payment processors, which can be a drawback for businesses with specific needs.

- Security concerns: Despite its security measures, PayPal has been targeted by phishing scams and fraudulent activities over the years. Users need to remain vigilant to protect their accounts.

- Limited international availability: While PayPal is available in many countries, it may not support transactions in all currencies or regions. This can be a limitation for businesses with a global customer base.

Compare PayPal to other tools

Stripe compared to PayPal

Stripe and PayPal are two leading online payment platforms with distinct advantages. Stripe offers extensive customization options, making it a favorite among developers and businesses looking for flexible payment solutions. Its transparent pricing and support for various payment methods cater to diverse needs.

On the other hand, PayPal boasts widespread recognition and user-friendliness, making it a trusted choice for businesses of all sizes. While Stripe may require more technical expertise, it excels in flexibility and integration capabilities. In contrast, PayPal's simplicity and ease of use appeal to a broad audience. Your choice between the two depends on your specific business requirements and technical comfort level.

Is Stripe better than PayPal?

Determining whether Stripe is better than PayPal depends on your specific needs. Stripe offers deep customization and developer-friendly tools, making it ideal for businesses seeking flexibility and integration options. Its transparent pricing is favorable for some.

PayPal, with its widespread recognition and user-friendliness, suits a broader audience, especially for businesses focused on simplicity and ease of use. However, PayPal's fees, account holds, and limited customization may not align with every business's requirements. Ultimately, the choice hinges on factors like technical expertise, customization needs, and your target audience's preferences.

What is Stripe best used for?

Stripe is best used for businesses seeking a highly customizable and developer-friendly payment processing solution. It excels in providing tools for seamless integration into websites and applications, making it ideal for e-commerce platforms, subscription-based services, and businesses requiring tailored payment experiences.

Stripe's support for various payment methods, currencies, and its transparent pricing structure caters to those with diverse payment needs. It's particularly well-suited for businesses looking to create a customized payment flow, offering control and flexibility for developers. Stripe's robust security measures also make it a reliable choice for handling sensitive financial transactions securely.

Can Stripe replace PayPal?

Stripe can replace PayPal for many businesses, but it depends on specific needs. Stripe's developer-friendly approach and extensive customization options make it a preferred choice for those seeking flexibility and advanced integration capabilities. However, PayPal's widespread recognition and user-friendly interface are beneficial for businesses targeting a broader audience looking for simplicity.

Whether Stripe can replace PayPal depends on factors like technical expertise, customization requirements, and the preferences of your target audience. Many businesses use Stripe alongside PayPal to offer customers multiple payment options, ensuring convenience and flexibility in their payment processing methods.

Is Stripe cheaper than PayPal?

Stripe and PayPal have different fee structures, making it essential to evaluate costs based on your specific business needs. Generally, Stripe's pricing is transparent, with no setup or monthly fees, and charges based on successful transactions. PayPal, however, combines a percentage-based fee with a fixed fee per transaction, which can be costlier, especially for smaller transactions.

Additionally, PayPal may charge higher fees for international transactions. To determine which is cheaper for your business, consider factors like transaction volume, average transaction size, and the countries you operate in. Carefully comparing their fees will help you make a cost-effective choice.

Is there a better Payments software than Stripe?

When contemplating online payment processing solutions, it's vital to explore whether there might be a more suitable alternative to Stripe for your particular requirements.

There are several noteworthy contenders in the payment processing landscape, including PayPal, Square, Braintree, and Authorize.Net.

The choice of which payment gateway to utilize depends on factors such as your business's technical capabilities, customization needs, security requirements, and budget constraints. While Stripe is known for its flexibility and developer-friendly features, other solutions may outshine it in areas like user-friendliness, established user bases, additional services, or cost-effectiveness, ultimately offering a better fit for your online payment processing strategy.

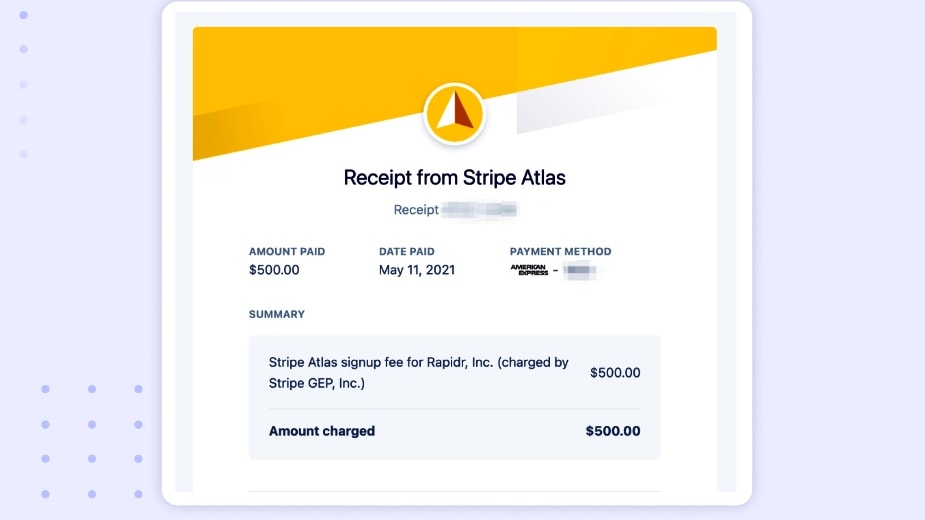

Waived Stripe fees on your next $20,000 in payment processing on Stripe

Get Waived Stripe fees on your next $20,000 in payment processing on Stripe and up to $500 savings with Secret.

PayPal compared to Stripe

PayPal and Stripe are leading online payment platforms, each with distinct strengths. PayPal, known for its widespread recognition, offers a user-friendly interface and broad accessibility, making it a preferred choice for businesses targeting a diverse audience.

In contrast, Stripe is favored by developers for its customization options, flexibility, and seamless integration capabilities. Stripe's transparent pricing structure is appealing to businesses seeking control and transparency in their payment processing. The choice between PayPal and Stripe depends on factors such as technical expertise, customization needs, and the preferences of your target audience.

Is PayPal better than Stripe?

Determining whether PayPal is better than Stripe depends on your specific business needs. PayPal's widespread recognition and user-friendliness make it a popular choice, particularly for businesses targeting a broad audience seeking simplicity. However, Stripe, with its developer-centric approach and customization options, appeals to those who require flexibility and advanced integration capabilities.

Whether PayPal is better than Stripe hinges on factors like technical expertise, customization requirements, and the preferences of your target audience. Many businesses use both platforms to offer customers multiple payment options, ensuring convenience and meeting various payment processing needs.

What is PayPal best used for?

PayPal is best used for businesses and individuals looking for a convenient and widely recognized online payment solution. It excels in providing a user-friendly platform for processing payments, making it suitable for e-commerce, freelancers, and businesses of all sizes. PayPal's versatility allows it to handle a variety of payment methods, including credit/debit cards, bank transfers, and PayPal balances.

Additionally, PayPal is well-suited for international transactions and offers buyer and seller protection, enhancing trust and security in online transactions. Its mobile apps and mobile-optimized website further make it a preferred choice for users on smartphones and tablets, ensuring ease of use on various devices.

Can PayPal replace Stripe?

PayPal can potentially replace Stripe for some businesses, depending on their specific needs. PayPal offers a user-friendly interface and widespread recognition, making it suitable for businesses aiming to simplify the payment process and cater to a broad audience. However, Stripe's strengths lie in customization, developer-friendliness, and advanced integration capabilities, making it a preferred choice for businesses seeking more control and flexibility.

Whether PayPal can replace Stripe depends on factors like technical requirements, customization needs, and the preferences of your target audience. Some businesses choose to use both platforms to provide customers with multiple payment options and meet diverse payment processing needs.

Is PayPal cheaper than Stripe?

Whether PayPal is cheaper than Stripe depends on your specific business circumstances. PayPal and Stripe have different fee structures. PayPal’s pricing typically charges a percentage-based fee along with a fixed fee per transaction, which may be higher for certain transactions.

Stripe, on the other hand, uses a transparent pricing model based on successful transactions, without setup or monthly fees. The cost-effectiveness of each platform will vary depending on factors like transaction volume, average transaction size, and the countries you operate in. To determine which is cheaper for your business, it's essential to evaluate the fees based on your specific payment processing needs.

Is there a better Payments software than PayPal?

When exploring alternatives to PayPal, it's essential to investigate whether there might be a more suitable online payment solution for your unique business needs.

Several notable alternatives to PayPal in the online payment processing landscape include Stripe, Square, QuickBooks Payments, Venmo, and others.

The decision on which payment gateway to use depends on factors such as your technical requirements, customization needs, security preferences, and budget constraints. While PayPal offers widespread recognition and user-friendliness, other solutions may excel in areas like developer-friendliness, advanced features, or cost-effectiveness. Carefully evaluating these factors will help you determine if there is an online payment processing software better suited to your specific requirements than PayPal.

Features comparison

PayPal's Intuitive Interface Outshines Stripe for User-Friendliness

When evaluating Stripe and PayPal for online payment processing, user-friendliness plays a crucial role. While both platforms offer reliable services, PayPal stands out with its intuitive interface, making it exceptionally user-friendly.

For example, PayPal's straightforward setup process allows businesses to start accepting payments quickly without requiring extensive technical knowledge. Additionally, PayPal provides a user-friendly dashboard that simplifies transaction tracking, fund management, and dispute resolution.

Stripe, on the other hand, offers powerful features but may be considered more developer-centric, requiring a bit more technical expertise for customization and integration. While both platforms serve their purposes well, PayPal's ease of use can be a deciding factor for businesses seeking a hassle-free payment processing experience.

Stripe and PayPal Both Shine in Facilitating International Transactions

When it comes to facilitating international transactions, both Stripe and PayPal emerge as formidable options, each with its unique advantages. These platforms excel at offering comprehensive international payment solutions, enabling businesses to tap into global markets with ease.

Both Stripe and PayPal support transactions in multiple currencies, allowing businesses to conduct transactions in their customers' preferred currency. This flexibility simplifies the shopping experience for international customers, reducing the friction of currency conversion.

Moreover, both platforms offer localized payment methods for various countries. For example, PayPal supports local payment options like iDEAL in the Netherlands, ensuring that businesses can cater to specific regional preferences.

PayPal's One Touch Feature Elevates Checkout Efficiency, Surpassing Stripe's Customizable Payment Process

PayPal's One Touch feature shines as a tool that significantly enhances the checkout experience. This feature enables customers to complete transactions swiftly, without the need to repeatedly enter passwords or payment details. Such a seamless and user-friendly payment experience can effectively reduce cart abandonment rates, leading to higher conversion rates for businesses. For instance, when customers shop on e-commerce sites that support PayPal's One Touch, they can complete their purchases with just a single click, a convenient advantage that encourages swift transactions.

On the other hand, Stripe, while providing customizable checkout forms that align with a business's branding, doesn't offer the same level of quick checkout as PayPal's One Touch. This makes PayPal the preferred choice for businesses prioritizing an expedited payment process.

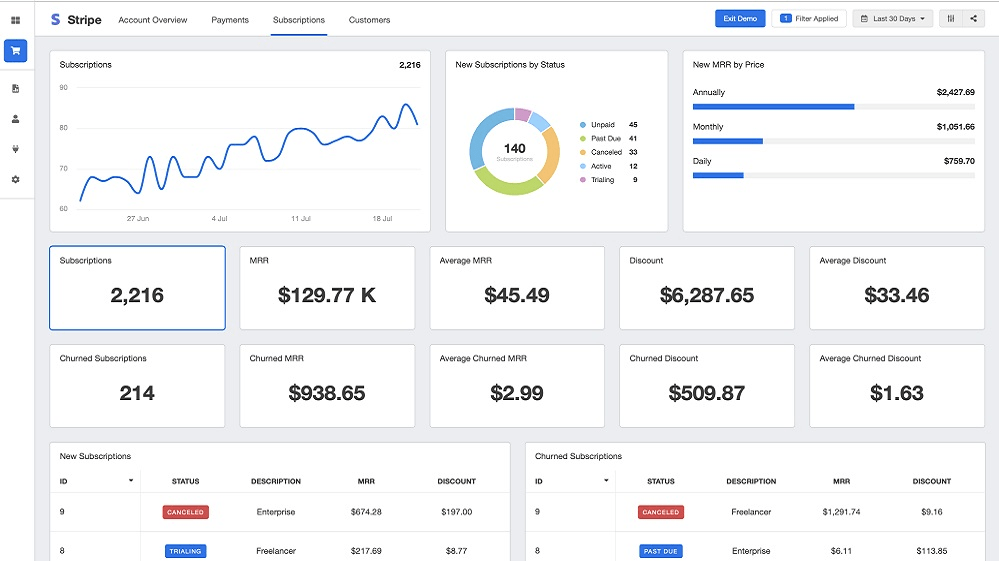

Stripe Leads with Superior Analytics, Offering Deeper Insights Compared to PayPal

Stripe takes the lead with its comprehensive and detailed capabilities. Stripe provides businesses with a wealth of insights into their financial transactions. This includes the ability to track transaction volumes, revenue trends, customer behavior, and more. These detailed analytics empower businesses to make informed decisions based on their payment data. For example, an e-commerce business using Stripe can identify top-selling products, monitor customer retention, and optimize pricing strategies with these insights.

While PayPal does offer some level of reporting, it doesn't match the depth and breadth of Stripe's analytics. PayPal's reporting is more basic and may not provide businesses with the granular data needed for in-depth analysis and strategic decision-making.

Stripe Outshines PayPal in Offering a More Streamlined and Comprehensive Subscription Billing Service

When it comes to subscription billing services, Stripe surpasses PayPal in providing a comprehensive and user-friendly solution. Stripe offers businesses the capability to set up recurring payments seamlessly for subscription-based services. This feature encompasses various billing frequencies, trial periods, and customizable subscription plans to cater to specific business needs. For instance, a software-as-a-service (SaaS) company can easily create monthly or annual subscription plans with free trial periods using Stripe's subscription billing features.

On the contrary, PayPal lacks a dedicated subscription billing feature, which means businesses relying on PayPal may need to configure recurring payments manually. This can be cumbersome, particularly for companies with a significant subscriber base.

Stripe's Extensive Integration Versatility Outshines PayPal's Limited Customization

When it comes to integration possibilities between Stripe and PayPal, Stripe stands out as the more versatile option. Stripe offers a wide array of pre-built integrations with hundreds of top business tools spanning various categories. These integrations cover e-commerce platforms, CRM systems, invoicing & billing tools, and more. For example, Stripe seamlessly integrates with popular platforms like Shopify, Salesforce, and QuickBooks.

What sets Stripe apart is its robust API, allowing businesses to create custom solutions tailored to their unique needs. This level of customization enhances versatility, accommodating even the most specific business requirements.

On the other hand, while PayPal offers a significant number of integrations, it lacks the same level of customization as Stripe. This limitation may not fully address the unique demands of certain businesses.

PayPal's Instant Transfer Feature Offers Speedy Access to Funds, Outpacing Stripe

PayPal offers a distinct advantage with its instant transfer feature. This feature allows businesses to transfer funds from their PayPal account to their linked bank account almost immediately. This instant access to funds can greatly improve cash flow, which is crucial for businesses with ongoing expenses and financial obligations. For example, an e-commerce store using PayPal can quickly access revenue from sales to replenish inventory or cover operational costs.

On the other hand, Stripe typically takes a few days to transfer funds to a linked bank account. While Stripe provides reliable payment processing, this delay in fund transfer may not be ideal for businesses that require quick access to their earnings, especially when dealing with time-sensitive financial needs.

Subscribe to our newsletters.

No FOMO here. Stay up-to-date on all the latest deals and news with our monthly newsletter straight to your inbox like 118,000+ entrepreneurs (+ Get 10% off on on our Premium Membership!)

Stripe vs PayPal: Which is the best for your business?

Stripe is the best tool for you if:

- You require a highly customizable payment processing solution for your e-commerce website.

- Your business focuses on international transactions and needs support for multiple currencies and payment methods.

- You have technical expertise or developers on your team to leverage Stripe's API for advanced customization.

- You prioritize detailed analytics and reporting to make data-driven decisions about your payment processes.

- Your business needs to handle subscription billing with flexibility in plan customization and trial periods.

PayPal is the best tool for you if:

- You prioritize a user-friendly interface and want to cater to a broad audience with diverse technical backgrounds.

- Your business relies on the widespread recognition and trust associated with the PayPal brand.

- You seek versatile payment options, including credit cards, bank transfers, and PayPal balances, to accommodate various customers.

- You value buyer and seller protection features to minimize the risks of disputes and fraud in your transactions.

- You require mobile-friendly payment solutions with apps and mobile-optimized interfaces to reach customers on various devices.

Alternatives to Stripe & PayPal

Promotions on Payments software

Start saving on the best SaaS with Secret.

Secret has already helped tens of thousands of startups save millions on the best SaaS like Stripe, PayPal & many more. Join Secret now to buy software the smart way.