Stripe vs Stripe Atlas: Selecting the ideal payment platform for your business

- 01Stripe vs Stripe Atlas: overview

- 02What's the difference between Stripe and Stripe Atlas?

- 03Stripe pros and cons

- 04Stripe Atlas pros and cons

- 05Stripe compared to Stripe Atlas

- 06Stripe Atlas compared to Stripe

- 07Features comparison

- 08Stripe vs Stripe Atlas: Which is the best for your business?

- 09Promotions on Payments software

- 10Alternatives to Stripe & Stripe Atlas

Access up to $500 savings on Stripe & $250 on Stripe Atlas

Access up to $500 savings on Stripe & $250 on Stripe Atlas

Selecting the appropriate payment processing system is crucial for optimizing transactions, ensuring security, and enhancing customer experience. These systems play a pivotal role in managing financial flows, facilitating seamless payment processing, and maintaining robust security protocols. Additionally, payment platforms can significantly influence customer satisfaction, streamline accounting processes, and support various payment methods.

With numerous payment solutions available, how do you determine the most suitable one for your business? In this article, we assist you by offering an in-depth comparison of two prominent payment platforms, Stripe vs Stripe Atlas. By examining their key features and fundamental differences, you'll gain the insights needed to make an informed decision that aligns with your business requirements.

Stripe vs Stripe Atlas: overview

Stripe and Stripe Atlas are two significant entities in the world of online payment processing and business infrastructure, each catering to different aspects of financial management and business setup.

Stripe is highly regarded for its comprehensive payment processing capabilities, favored by businesses of all sizes for facilitating online transactions. It offers a robust platform that excels in handling various payment methods, ensuring secure transactions, and integrating seamlessly with numerous online systems. Conversely, Stripe Atlas is tailored towards entrepreneurs and startups, specializing in business formation and infrastructure. It provides services like company incorporation, banking setup, and initial legal framework, making it a go-to solution for new businesses looking to establish themselves quickly and efficiently.

When deciding between Stripe and Stripe Atlas, it's essential to assess your specific business objectives, the stage of your business, and your financial management needs. Stripe is an optimal choice for businesses seeking a reliable and versatile online payment system, while Stripe Atlas is ideal for startups and entrepreneurs requiring assistance in setting up their business infrastructure and legal frameworks. Both platforms offer distinct yet complementary services, making them valuable for different stages and aspects of business growth.

What's the difference between Stripe and Stripe Atlas?

Stripe and Stripe Atlas are both integral parts of the modern financial and business infrastructure landscape, offering distinct services that cater to different needs within the business ecosystem. Understanding the differences between these two can be crucial in determining which is more suitable for your specific business requirements.

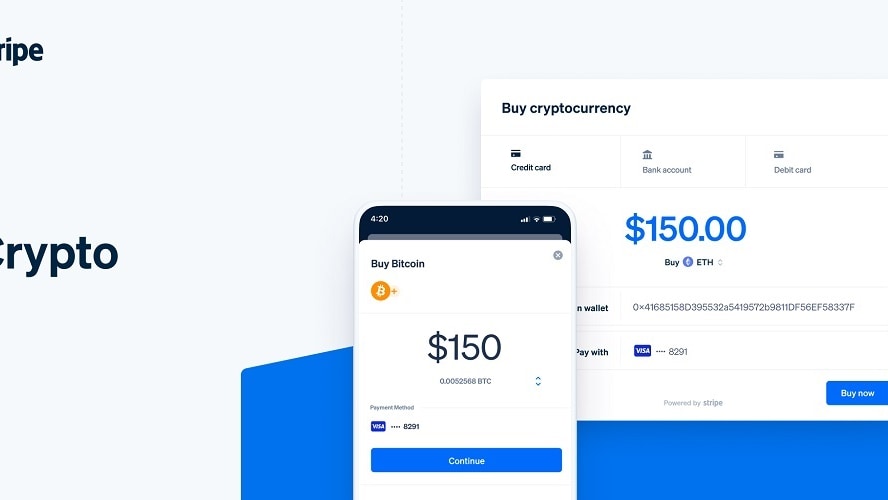

Stripe is primarily a payment processing platform, renowned for its ability to handle a wide range of online financial transactions seamlessly. It's designed to integrate effortlessly with various e-commerce and business platforms, making it a favorite among online retailers, service providers, and businesses looking to accept payments over the internet. Stripe's robust API allows for extensive customization, enabling businesses to tailor the payment process to their specific needs. This includes accepting multiple currencies, recurring billing, and implementing advanced security measures.

On the other hand, Stripe Atlas is a business infrastructure tool aimed at helping startups and entrepreneurs establish their business entity. It's particularly useful for those looking to form a company in the United States, even from abroad. Stripe Atlas assists with the legal and bureaucratic aspects of starting a business, such as incorporating a company, setting up a U.S. bank account, and providing legal and tax guidance. It's a comprehensive solution for entrepreneurs who need assistance navigating the complexities of setting up a new business, especially in a foreign market.

The key difference lies in their primary functions: Stripe focuses on facilitating financial transactions, while Stripe Atlas is dedicated to helping set up the structural framework of a business. While Stripe offers a solution for managing ongoing financial transactions, Stripe Atlas provides foundational support for entrepreneurs at the initial stages of their business journey.

When considering which service to use, it's important to evaluate the stage and nature of your business. If you're looking for a reliable and versatile online payment system, Stripe is the way to go. However, if you're at the inception phase of your business and require assistance with incorporation and legal setup, especially in the U.S., Stripe Atlas would be the more appropriate choice.

Stripe pros and cons

What are the advantages of Stripe?

- Wide range of payment options: Stripe supports a variety of payment methods, including credit cards, debit cards, and newer forms like Apple Pay and Google Pay. This flexibility is advantageous for businesses looking to cater to a broad customer base with varying payment preferences.

- Global reach: Stripe operates in numerous countries and supports multiple currencies, making it ideal for businesses with a global customer base or those looking to expand internationally.

- Advanced security features: Stripe places a strong emphasis on security, employing advanced measures such as encryption, secure tokenization, and compliance with PCI DSS standards to protect sensitive data.

- Developer-friendly: Stripe provides a robust set of APIs, allowing developers to integrate and customize the payment process seamlessly into various platforms and applications. This customization capability is particularly beneficial for businesses with unique or evolving payment processing needs.

- Transparent pricing: Stripe offers clear, straightforward pricing with no hidden fees. This transparency is helpful for businesses in planning their finances and avoiding unexpected costs.

What are the disadvantages of Stripe?

- Transaction fees: While Stripe's fees are competitive, they can accumulate, especially for businesses with a high volume of transactions or those processing smaller amounts, as Stripe charges a flat fee plus a percentage of each transaction.

- Complexity for non-developers: The extensive customization options, while beneficial for developers, can be overwhelming for non-technical users. Businesses without a dedicated development team might find the platform challenging to navigate.

- Limited customer support: Some users have reported that Stripe's customer support can be less accessible or slower to respond compared to some other payment platforms, which could be a drawback for businesses needing immediate assistance.

- Chargebacks and dispute fees: Stripe charges a fee for processing chargebacks and disputes. This can be a con for businesses in industries where chargebacks are more common.

- Not suitable for all business types: Stripe has a list of restricted businesses and activities that it does not support. Businesses in these categories will have to seek alternative payment processors.

Compare Stripe to other tools

Stripe Atlas pros and cons

What are the advantages of Stripe Atlas?

- Streamlined business setup: Stripe Atlas simplifies the process of starting a business, especially for non-US residents. It assists with incorporating a company in the US, setting up a US bank account, and obtaining a tax ID, which can be challenging to navigate independently.

- Access to the Stripe ecosystem: Users of Stripe Atlas gain access to the Stripe payment platform, which is advantageous for online businesses needing to process payments globally. This integration can be particularly beneficial for startups looking to scale quickly.

- Legal and tax guidance: Stripe Atlas provides users with templates and tools for legal documents, such as bylaws and stock issuance, and offers guidance on tax issues, which is invaluable for new entrepreneurs unfamiliar with these aspects.

- Networking and resource opportunities: Stripe Atlas members gain access to a network of entrepreneurs, as well as discounts and credits for various services such as cloud hosting, which can be crucial for startups looking to minimize initial costs.

- Reputation and trust: Being incorporated in the US, often viewed as a favorable business environment, can lend credibility and trust to your business in the eyes of customers, investors, and partners.

What are the disadvantages of Stripe Atlas?

- Costs and fees: The service isn't free, and there are ongoing costs associated with maintaining a US corporation, including state fees and taxes, which may be higher than in other jurisdictions.

- Limited flexibility in choice of state for incorporation: Stripe Atlas typically incorporates businesses in Delaware, which may not be the most advantageous state for all types of businesses due to its specific legal and tax structures.

- Complexity for non-US residents: While Stripe Atlas simplifies many aspects of starting a business in the US, non-US residents may still face complexities in understanding and complying with US tax laws and business regulations.

- Not suitable for all business types: Just like Stripe, Stripe Atlas has restrictions on certain types of businesses, which means it might not be a viable option for everyone.

- Potential overhead for small businesses: For very small businesses or solo entrepreneurs, the formalities and costs associated with maintaining a US corporation (like annual reporting and accounting requirements) might be more burdensome than beneficial.

Compare Stripe Atlas to other tools

Stripe compared to Stripe Atlas

Stripe and Stripe Atlas, though part of the same overarching company, serve distinct purposes in the business ecosystem. Stripe is renowned as a comprehensive payment processing platform, ideal for businesses seeking a reliable method to handle online transactions. It offers extensive customization options and supports various payment methods, catering to a global clientele.

In contrast, Stripe Atlas specializes in facilitating the initial stages of business setup, particularly for startups and entrepreneurs. It simplifies the complexities of incorporating a company in the US, setting up banking, and navigating legal frameworks. While Stripe enhances transactional capabilities, Stripe Atlas provides foundational support for new business ventures.

Is Stripe better than Stripe Atlas?

Determining whether Stripe is better than Stripe Atlas depends on your specific needs. Comparing Stripe to Stripe Atlas isn't a matter of which is better, but rather which service best suits your specific needs. Stripe excels as a payment processing solution, offering robust tools for businesses to manage online transactions efficiently and securely. It's ideal for those who need a sophisticated platform for handling payments.

On the other hand, Stripe Atlas is tailored for entrepreneurs and startups needing assistance in establishing their business, especially in the U.S. It simplifies complex processes like company incorporation and banking setup. Essentially, while Stripe optimizes ongoing financial transactions, Stripe Atlas provides essential infrastructure for starting and structuring a new business.

What is Stripe best used for?

Stripe is best utilized as a versatile and powerful payment processing platform, ideal for businesses of all sizes that require an efficient, secure method for handling online transactions. Its strength lies in its ability to seamlessly integrate with a wide array of e-commerce systems and support various payment methods, making it a popular choice for online retailers, service providers, and any business conducting digital transactions.

Additionally, Stripe's robust API caters to those seeking customization, allowing businesses to tailor the payment experience to their unique needs. This makes it especially valuable for companies looking to provide a smooth, reliable, and adaptable payment solution to their customers.

Can Stripe replace Stripe Atlas?

Stripe cannot replace Stripe Atlas as they serve fundamentally different purposes within the business landscape. Stripe is a powerful tool for processing online payments, designed to facilitate secure and efficient financial transactions for businesses and e-commerce platforms. Its focus is on the operational aspect of handling digital payments.

In contrast, Stripe Atlas is geared towards helping entrepreneurs and startups with the initial setup of their business, including legal incorporation, banking, and compliance in the United States. While Stripe streamlines transactional processes, Stripe Atlas provides the foundational framework for establishing and legally structuring a new business, addressing needs that Stripe doesn't cover.

Is Stripe cheaper than Stripe Atlas?

Comparing the cost-effectiveness of Stripe and Stripe Atlas is challenging due to their distinct service offerings. Stripe’s pricing, as a payment processing platform, charges per transaction, making its cost directly proportional to the volume and amount of transactions processed. For businesses with frequent online transactions, these costs can accumulate.

Stripe Atlas, on the other hand, involves a different pricing model, typically charging a one-time fee for the business setup services it provides, including incorporation and banking arrangements. While Stripe incurs ongoing transactional costs, Stripe Atlas's expenses are largely upfront. Therefore, determining which is cheaper depends on the specific financial activities and needs of a business.

Is there a better Payments software than Stripe?

While Stripe is a highly regarded payment processing platform known for its robust features and versatility, it's important to consider alternative software options to find the best fit for your business's unique payment processing needs.

Key alternatives to Stripe in the payment processing arena include PayPal, Square, Adyen, and Braintree. Each of these platforms offers distinct features and benefits that may align more closely with different business models and transaction requirements.

Choosing the most suitable payment processing software depends on factors like transaction fees, payment method diversity, global reach, security measures, and integration capabilities. If you prioritize seamless integration with e-commerce platforms, extensive payment method support, and developer-friendly tools, Stripe stands out as a strong option.

Waived Stripe fees on your next $20,000 in payment processing on Stripe

Get Waived Stripe fees on your next $20,000 in payment processing on Stripe and up to $500 savings with Secret.

Stripe Atlas compared to Stripe

Stripe Atlas and Stripe, while originating from the same company, cater to distinctly different business needs. Stripe Atlas is specifically designed to assist entrepreneurs in launching their businesses, primarily focusing on legal and bureaucratic aspects like company incorporation, bank account setup, and initial tax advisories, particularly for those establishing a presence in the U.S.

In contrast, Stripe operates as a comprehensive payment processing platform, geared towards enabling businesses of all sizes to conduct online financial transactions seamlessly. It offers a wide range of payment options, security features, and integrations with e-commerce systems, making it a go-to choice for digital transaction management.

Is Stripe Atlas better than Stripe?

Determining whether Stripe Atlas is better than Stripe depends on the specific needs of a business. Stripe Atlas is tailored for entrepreneurs setting up a new business, particularly useful for handling legal incorporation, banking, and initial tax setups, especially in the U.S. It's a foundational service for startups beginning their journey.

Conversely, Stripe is a payment processing platform, essential for businesses seeking to manage online transactions effectively. It offers a wide array of payment options and robust security measures. Thus, the comparison hinges on whether the need is for establishing a business (Stripe Atlas) or for handling financial transactions (Stripe).

What is Stripe Atlas best used for?

Stripe Atlas is best utilized for providing entrepreneurs, especially those outside the United States, with a streamlined pathway to establish and legally structure their businesses in the U.S. It excels in simplifying complex processes like company incorporation, creating a U.S. bank account, and offering initial tax and legal guidance. This makes it particularly valuable for startups and international entrepreneurs seeking to tap into the U.S. market.

Additionally, Stripe Atlas offers access to a network of resources and tools beneficial for early-stage business development, making it an ideal choice for new ventures needing a solid foundation in a competitive business environment.

Can Stripe Atlas replace Stripe?

Stripe Atlas cannot replace Stripe, as they serve distinct functions within the business landscape. Stripe Atlas is specifically designed to assist entrepreneurs in establishing their businesses, particularly focusing on legal incorporation, setting up banking solutions, and navigating initial tax complexities, mainly in the U.S. context. Its primary role is to provide a foundational framework for new businesses.

On the other hand, Stripe operates as a comprehensive payment processing platform, crucial for businesses that need to manage online financial transactions. It offers a range of payment options, security features, and integration capabilities. Thus, while Stripe facilitates financial transactions, Stripe Atlas lays the groundwork for business formation.

Is Stripe Atlas cheaper than Stripe?

Comparing the cost-effectiveness of Stripe Atlas and Stripe is like comparing apples and oranges, as they offer distinct services with different pricing structures. Stripe Atlas’s pricing charges an upfront fee for business incorporation services, which includes legal and banking setup, primarily a one-time cost for new business formation.

In contrast, Stripe operates on a transaction-based pricing model, where costs are incurred per transaction, making it an ongoing expense related to payment processing. Therefore, while Stripe Atlas involves a fixed initial investment, Stripe's costs are recurrent and depend on the volume of financial transactions processed by a business. The "cheaper" option depends on the specific services required.

Is there a better Company Formation software than Stripe Atlas?

While Stripe Atlas is a robust tool for business incorporation and setup, especially for startups and entrepreneurs aiming to establish a presence in the U.S., exploring alternative software options is essential to ensure the best fit for your specific business needs.

Notable alternatives to Stripe Atlas in the realm of business formation and legal infrastructure services include doola, Firstbase, ZenBusiness, LegalZoom, and Incfile. These platforms offer varying features, from legal document preparation to registered agent services and business advisory.

The choice of the ideal business setup service hinges on your company's specific requirements, such as the nature of the incorporation, legal support needs, and budgetary constraints. While Stripe Atlas offers a comprehensive package for U.S. incorporation and banking setup, these alternatives might provide more tailored services or different pricing models.

$250 off for the incorporation of your company on Stripe Atlas

Get $250 off for the incorporation of your company on Stripe Atlas and up to $250 savings with Secret.

Features comparison

Stripe's Versatile Integration Suite Outshines Stripe Atlas for E-commerce

When comparing the integration capabilities of Stripe and Stripe Atlas, it's clear that both offer an impressive array of integrations, but Stripe takes a significant lead in terms of flexibility and breadth. Stripe's API seamlessly integrates with a wide range of e-commerce and content management system (CMS) platforms, allowing businesses to effortlessly set up online payment systems. For instance, Stripe's integration with popular platforms like Shopify, WooCommerce, and Magento ensures a seamless shopping experience for customers and streamlined payment processing for businesses.

On the other hand, Stripe Atlas, while providing its own set of integrations, primarily focuses on enhancing businesses' global operations beyond just online transactions. Its integrations revolve around connecting entrepreneurs with legal, banking, and tax services to facilitate international business expansion. While these integrations are undeniably valuable, they lack the same variety and flexibility found in Stripe's e-commerce-focused integrations.

Stripe Atlas Streamlines Business Setup with Legal Assistance, a Key Differentiator from Stripe

When comparing Stripe Atlas and Stripe, a notable distinction arises in their approach to business establishment. Stripe Atlas stands out for its dedication to simplifying the process of creating an account and handling all associated legal formalities. This unique feature provides Stripe Atlas with a significant advantage over Stripe, which primarily concentrates on payment processing without offering explicit support for navigating the intricate legal aspects of business establishment.

For instance, Stripe Atlas offers comprehensive support in forming a legal entity, handling tax-related matters, and even setting up a business bank account, which can be particularly beneficial for entrepreneurs venturing into international markets. In contrast, Stripe's primary focus remains on facilitating online payments, lacking the comprehensive legal support provided by Stripe Atlas.

Subscription Billing is Equally Efficient in both Stripe and Stripe Atlas

In the realm of subscription management, both Stripe and Stripe Atlas showcase commendable capabilities. Stripe, as a standalone payment processing powerhouse, excels in this area with its robust recurring billing features. For instance, businesses can easily set up and manage subscription plans, customize billing cycles, and handle complex subscription scenarios, all within the Stripe platform. This level of flexibility and control simplifies the task of maintaining subscription-based services, ensuring a seamless experience for customers.

On the other hand, Stripe Atlas leverages the integrated Stripe suite to competently handle subscriptions. While it inherits some of Stripe's subscription management capabilities, its primary focus extends beyond this aspect to encompass the broader scope of assisting entrepreneurs in establishing global business entities.

Stripe's Global Payment Dominance Trumps Stripe Atlas's Suite Integration

When evaluating Stripe and Stripe Atlas in terms of their primary features, Stripe clearly excels in the realm of payment processing. Stripe boasts formidable capabilities, allowing businesses to effortlessly accept payments from customers worldwide through a diverse array of payment methods. For instance, Stripe supports credit and debit card payments, digital wallets like Apple Pay and Google Pay, and even international payment methods, ensuring seamless transactions for businesses and customers alike.

While Stripe Atlas does integrate the Stripe Suite for payment, billing, and subscription management, its primary focus extends beyond payment processing. Consequently, it offers less versatility in this regard compared to Stripe itself. While Stripe Atlas is invaluable for facilitating the creation of global business entities, entrepreneurs seeking robust, feature-rich payment processing will find Stripe to be the superior choice.

Stripe's Intuitive Interface Outshines Stripe Atlas for User-Friendly Experience

When evaluating the user-friendliness of Stripe and Stripe Atlas, Stripe emerges as the more accessible and beginner-friendly option. Stripe is tailored for simplicity, boasting a clean, intuitive interface that even individuals new to the world of eCommerce can swiftly grasp. It offers user-friendly step-by-step guidance for various processes, such as setting up payments or processing refunds. For instance, when setting up payment processing, Stripe simplifies the integration process with easy-to-follow instructions and customizable features.

In contrast, Stripe Atlas caters more to experienced, tech-savvy entrepreneurs seeking to expand their businesses globally. While it provides a robust suite of tools for managing operations, establishing legal structures, and forming banking relationships, it may appear overwhelming to newcomers. Navigating Stripe Atlas can be intricate, demanding a substantial time commitment to master its multifaceted functionalities. For instance, entrepreneurs using Stripe Atlas to create a legal entity may need to navigate complex legal requirements, which can be challenging without prior expertise.

Stripe Offers Superior Fraud Prevention Features than Stripe Atlas

In the realm of online transaction security, Stripe emerges as the undisputed leader, boasting a distinctive edge over Stripe Atlas. Stripe's commitment to safeguarding businesses from fraudulent activities is evident through its cutting-edge tool, Stripe Radar. This powerful feature incorporates advanced fraud detection algorithms, harnessing the capabilities of machine learning and data analysis to proactively identify and prevent fraudulent transactions. For example, Stripe Radar can flag suspicious activities based on various factors, such as unusual payment patterns or geographical anomalies, offering businesses a robust defense against fraudsters.

On the contrary, Stripe Atlas, while invaluable for business formation and global expansion, does not explicitly bundle advanced security features as part of its package. Its primary focus lies in simplifying the process of establishing international business entities.

International Expansion is More Streamlined with Stripe Atlas, than with Stripe

When considering international business growth, both Stripe and Stripe Atlas offer valuable features, but Stripe Atlas takes an additional stride by providing international incorporation options. This is a key distinction between the two platforms. Stripe Atlas facilitates global expansion by offering incorporation services in several countries, streamlining the often complex process of establishing a business entity abroad. For instance, entrepreneurs can choose to incorporate their businesses in countries like the United States, which can be particularly advantageous for access to the U.S. market.

On the other hand, Stripe primarily excels in enabling businesses to accept payments in multiple currencies, making it easier for them to serve a global customer base. However, Stripe doesn't offer as extensive support for the intricate aspects of international business incorporation as Stripe Atlas does.

Subscribe to our newsletters.

No FOMO here. Stay up-to-date on all the latest deals and news with our monthly newsletter straight to your inbox like 118,000+ entrepreneurs (+ Get 10% off on on our Premium Membership!)

Stripe vs Stripe Atlas: Which is the best for your business?

Stripe is the best tool for you if:

- You're an e-commerce business looking for seamless payment processing and a wide range of supported payment methods, including credit cards and digital wallets

- You require a user-friendly platform with robust developer tools and APIs, making it easy to integrate payment functionality into your website or app

- You need comprehensive fraud prevention features and real-time transaction monitoring to safeguard your business and customers' financial data

- You want access to advanced analytics and reporting tools that provide insights into your sales, customer behavior, and payment performance

- You value scalability and flexibility, as it can accommodate businesses of all sizes, from startups to large enterprises, and adapt to your evolving payment needs

Stripe Atlas is the best tool for you if:

- You're an aspiring entrepreneur looking to launch a global business quickly and easily with a streamlined incorporation process

- You want access to a wealth of resources, including legal and tax guidance, to navigate the complexities of international business operations

- You need a comprehensive toolkit for managing finances, accepting payments, and handling compliance matters in multiple countries

- You value the ability to establish a U.S. business presence, even if you're located outside the United States, to access a broader market and funding opportunities

- You seek a supportive community of fellow entrepreneurs and access to exclusive events and networking opportunities to help your startup thrive

Alternatives to Stripe & Stripe Atlas

Promotions on Payments software

Start saving on the best SaaS with Secret.

Secret has already helped tens of thousands of startups save millions on the best SaaS like Stripe, Stripe Atlas & many more. Join Secret now to buy software the smart way.